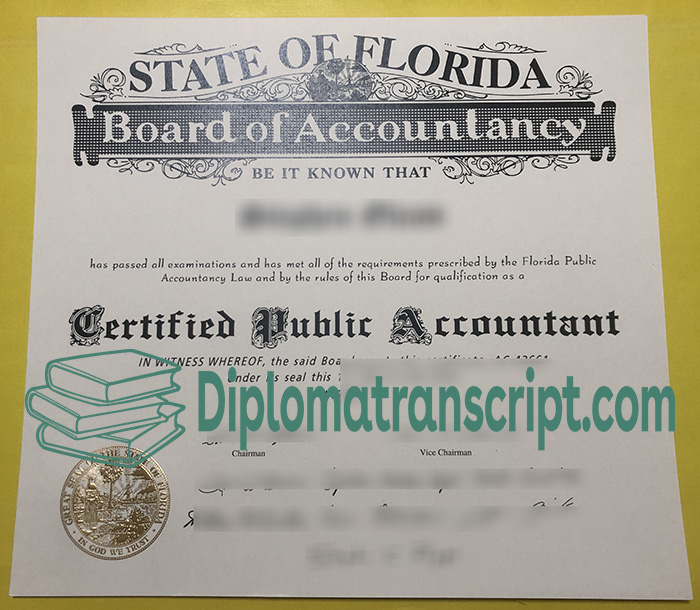

The Florida Certified Public Accountant (CPA) certificate is issued by the Florida Board of Accountancy and is a professional qualification for accounting practitioners in the state. Buy a Florida CPA Certificate. Order a Florida CPA Certificate online. How long to get a Florida CPA diploma? Holding this certificate indicates that an individual has a high level of accounting, auditing, taxation and financial management capabilities and meets the practice requirements of Florida.

Application conditions:

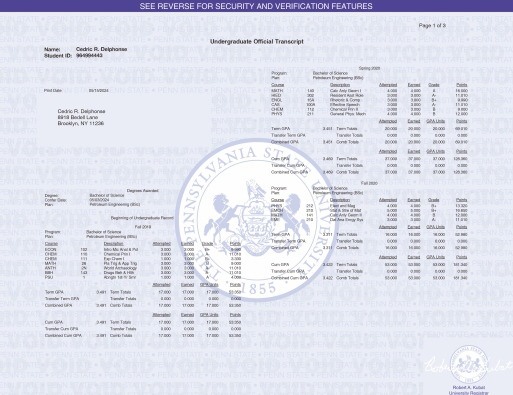

Education requirements: At least 150 credits, including specific accounting and business courses (such as 24 credits of accounting courses, including auditing, taxation, cost accounting, etc., and 24 credits of business courses).

Examination requirements: Pass the four unified CPA exams in the United States (AUD, BEC, FAR, REG).

Experience requirements: 1 year of relevant work experience (supervised by a certified CPA).

Certificate advantages:

You can engage in high-paying careers such as public accounting and corporate finance in Florida.

Highly recognized in the United States, some states can convert licenses through mutual recognition agreements.

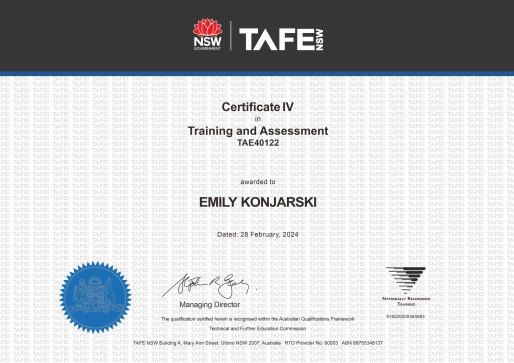

Continuing education (CPE) must be completed to maintain qualifications.

Florida has no residency requirements, attracting candidates from many places to apply. This certificate is an important qualification for the development of the accounting profession, enhancing employment competitiveness and professional credibility.

Find Answer Here

Find Answer Here