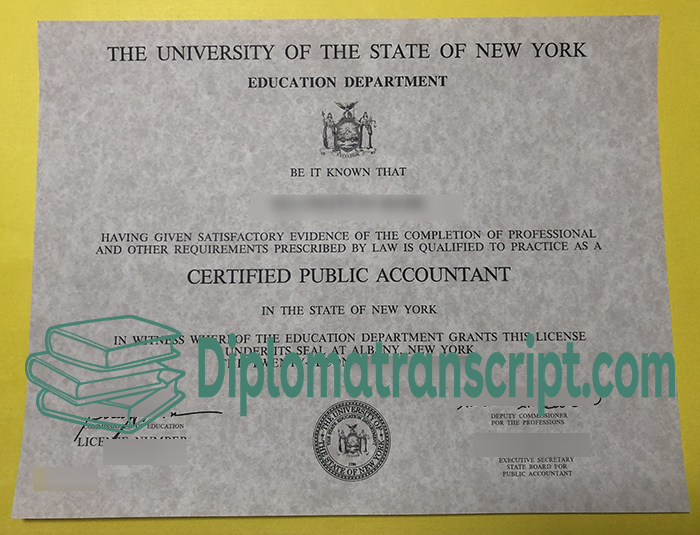

Buy a New York CPA Certificate. In order to ensure that practicing CPAs can ensure their professional competence and to ensure that CPAs can always be alert to their due obligations and responsibilities such as diligence, each state accounting board requires CPAs to take a certain number of continuing education credits (CPE credits) every year during their practice. At the same time, in order to ensure the quality of continuing education, the National Association of State Boards of Accountancy has set quality standards and specifications for CPE credits and courses.

New York AICPA—Specific requirements for CPE: How much to order a New York CPA Certificate?

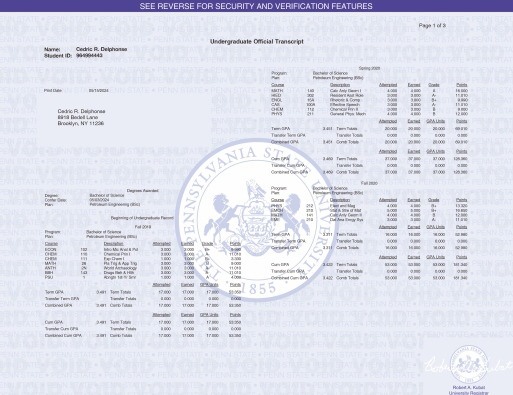

1. At least 40 hours in any recognized subject area, or 20 hours in one subject area;

2. The recognized subjects are technical in nature, including: Taxation, Accounting, Auditing, Advisory service, Attest, Specialized knowledge;

Find Answer Here

Find Answer Here