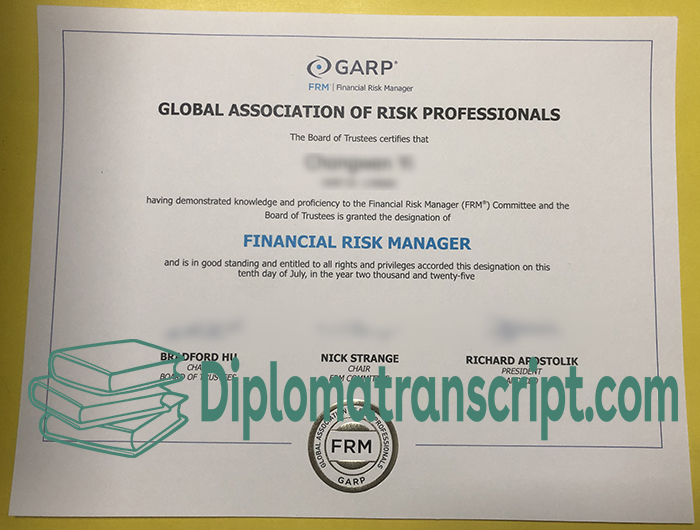

GARP FRM Certificate: The Gold Standard in Global Risk Management, Buy a GARP FRM Certificate online. How much to order a GARP FRM Certificate?

Certificate Positioning and Authority

The Financial Risk Manager (FRM®) certification was established by the Global Association of Risk Management Professionals (GARP) in 1997 and is an internationally recognized top certificate in the field of financial risk management. Its curriculum system covers cutting-edge risk theory and practical techniques.

Can I get a fake GARP certificate?

Core Values and Knowledge System

Comprehensive Risk Coverage

Part 1 (Basics): Quantitative Analysis, Market/Credit/Operational Risk Basics (100 questions)

Part 2 (Advanced): Liquidity Risk, Investment Risk Control, Frontier Cases (80 questions)

In-depth Focus: Core areas such as Basel Accord, Stress Testing Model, Derivatives Risk Control, and Machine Learning Applications.

Strict Certification Standards

The global average pass rate is only about 50%, and two levels of exams must be passed within 4 years.

Experience Requirements: After passing the exam, you must submit proof of more than 2 years of professional risk management practice to obtain the certificate.

Continuous learning: The holder needs to complete 20 hours of continuing education (CPE) every year.

Empowering professional competitiveness

Industry demand: 100% of the risk management positions of the top ten banks in the world require FRM certification (GARP 2022 report).

Salary premium: The average annual salary of FRM holders is 42% higher than that of their peers (up to $152,000 in the United States).

Career path: Covers high-level positions such as investment bank risk control officers, fund chief risk officers (CROs), and regulatory compliance directors.

Deep connection with the Chinese market

Policy endorsement: Included in the financial talent development plans of 16 provinces and cities including Shanghai/Shenzhen/Beijing, and enjoy settlement subsidies (up to 2 million yuan).

Institutional rigid demand: Regulatory agencies such as the Bank of China and the China Securities Regulatory Commission clearly require core risk control positions to hold FRM certificates. Buy a fake diploma, Buy a fake certificate.

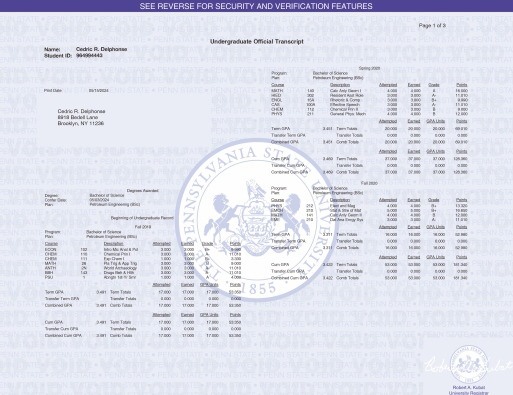

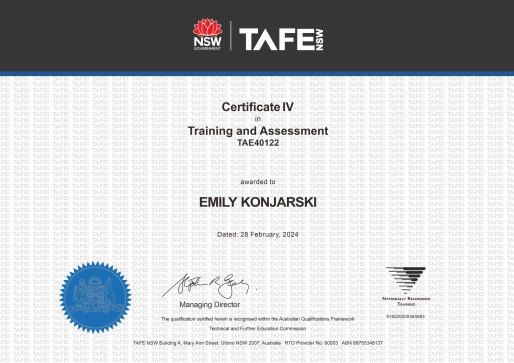

Find Answer Here

Find Answer Here