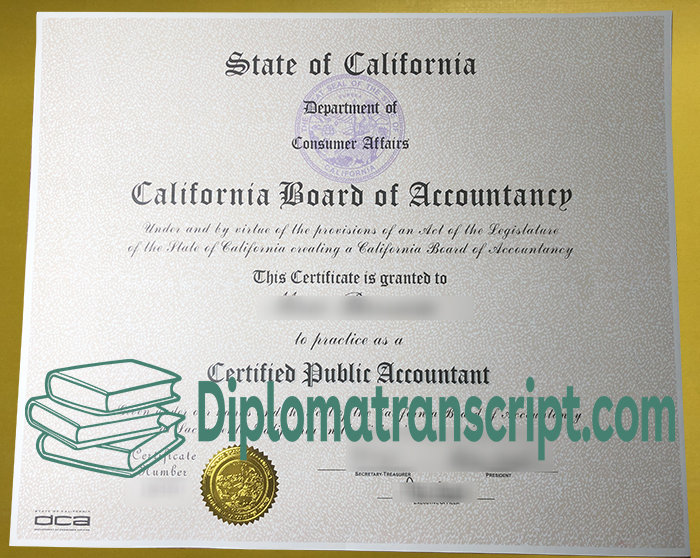

Buy a California CPA certificate in 2025. How much to get a California CPA certificate in the USA? 2025 California USCPA exam requirements: Bachelor degree or above, 120 total credits, including 24 accounting credits and 24 business credits. License requirements: Social security number required by law, bachelor degree, 24 accounting and 24 business credits, 2 years of non-firm work experience or 2 years of firm experience (including 500 hours of audit experience) are allowed, and the signatory must have a license and the license must be valid.

FAR (Financial Accounting and Reporting): Financial accounting foundation: accounting concept framework and regulatory system, accounting system, accounting system control, single entity accounting and other related knowledge. Financial accounting: knowledge of accounting standards for enterprises, non-profit organizations and government organizations, and the skills required for their application.

BEC (Business Environment and Theory): Management accounting foundation, business mathematics foundation, business economic foundation, business environment.

AUD (Audit and Attestation): Learning content includes: knowledge of audit procedures, generally accepted auditing standards and other attestation-related standards, and skills required for the execution of commissioned verification, etc.

REG (Laws and Regulations): Ethics, Corporate Governance and Business Law Foundations: Business and professional ethics, ethical conflicts, corporate governance, US laws and laws of other countries, contract law, labor law, corporate management and financing and other related knowledge.

Can I get a California CPA certificate online?

2. Certificate Value

USCPA is the only official national qualification for CPAs in the United States. Not only does it have the right to sign audits in the United States, but it also enjoys a high reputation around the world and can exchange CPAs in 8 countries and regions. With more and more Chinese companies entering the US capital market and more and more US companies landing in China, as one of the top certificates in the world’s accounting field, AICPA’s influence in China is increasing day by day, and the demand for AICPA talents by enterprises is also rising sharply. At present, the talent gap of AICPA in China alone is as high as 250,000.

3. Help for career development

USCPA is highly recognized internationally, and 64 countries and regions, including China, widely recognize this qualification. In general, the employment direction of USCPA students can cover firms, various enterprises, financial industries, etc. Many foreign companies, as well as private enterprises and large state-owned enterprises that need to develop overseas business, are hard to find USCPA certificate holders. Having a USCPA license will help you get twice the result with half the effort when it comes to going abroad, immigrating, and looking for jobs abroad.

Find Answer Here

Find Answer Here